CDFI Fund

The Community Development Financial Institutions (CDFI) Fund, administered by the U.S. Department of the Treasury, makes capital grants, equity investments and awards for technical assistance to community development financial institutions. The CDFI Fund was authorized by the Riegle Community Development and Regulatory Improvement Act of 1994.Since its inception, the Fund has made more than $1.4 billion in awards to community development organizations and financial institutions.

The Community Development Financial Institutions (CDFI) Fund, administered by the U.S. Department of the Treasury, makes capital grants, equity investments and awards for technical assistance to community development financial institutions. The CDFI Fund was authorized by the Riegle Community Development and Regulatory Improvement Act of 1994.Since its inception, the Fund has made more than $1.4 billion in awards to community development organizations and financial institutions.

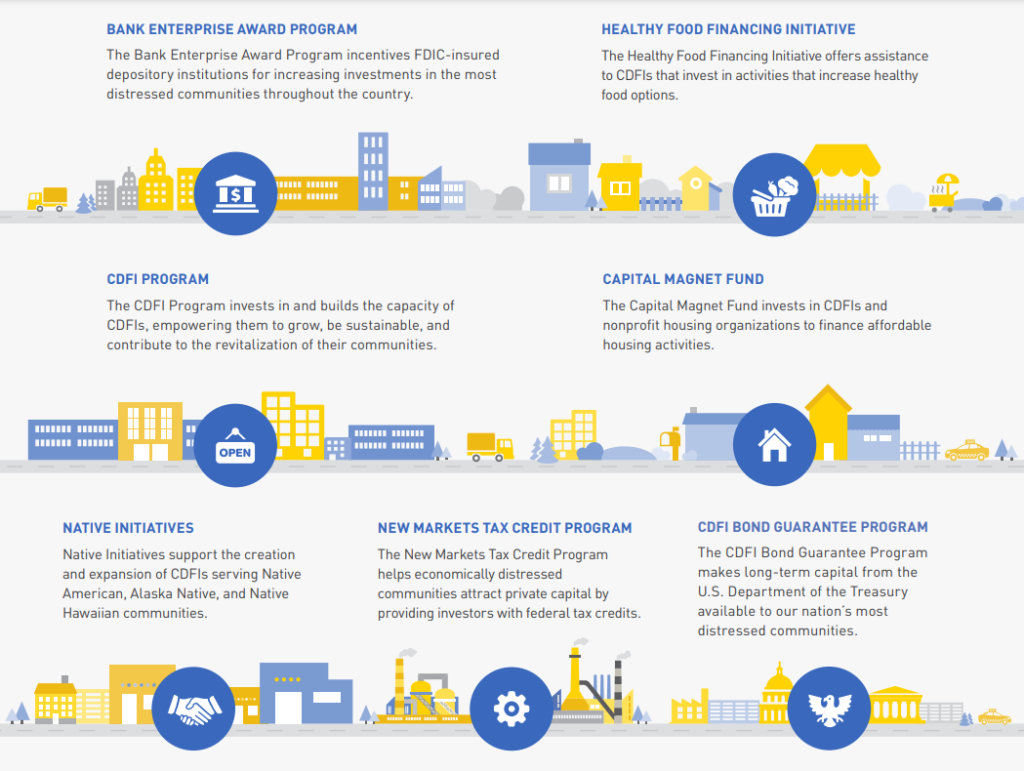

The CDFI Fund plays an important role in generating economic growth and opportunity in some of our nation’s most distressed communities. By offering tailored resources and innovative programs that invest federal dollars alongside private sector capital, the CDFI Fund serves mission-driven financial institutions that take a market-based approach to supporting economically disadvantaged communities.

The first step for these mission-driven organizations to accessing many of the CDFI Fund’s programs is applying for CDFI or CDE Certification. Although there are some exceptions, certification is the gateway to accessing the CDFI Fund’s award programs.

The CDFI Fund Program has several different program areas. Please click through the list below for each program’s summary. Through these components, the CDFI Program provides loans, equity investments, and grants to CDFIs to support their capitalization and capacity building, enhancing their ability to create community development impact in underserved markets. CDFIs compete for federal support based on their business plan, market analysis, and performance goals. To receive financial assistance, CDFIs must provide matching private and non-federal funds to obtain CDFI Fund support.

For more information about the Fund’s award programs, including, applications and eligibility requirements; and detailed breakdowns of awardees by component, year and state, visit the Fund’s website at www.cdfifund.gov

The Financial Assistance component makes Financial Assistance (FA) grants to certified CDFIs that create demonstrable community development impact in CDFI Fund priority areas, and can provide at least a 1:1 match with private, non-federal funds. FA funding is made to certified CDFIs regardless of asset size; however, larger CDFIs are expected to leverage greater degrees of non-federal dollars (above the required 1:1 ratio) for their FA awards and serve more targeted markets. In FY 2004 the CDFI Fund reintroduced a Small and Emerging CDFI (SECA) category as part of the FA component. The SECA category provides smaller levels of financial assistance to CDFIs with a small amount of assets or those that have been in operation for less than three years. Applications for FA awards are usually due in the spring with awards being announced in late summer/early fall.- with awards being announced in late summer/early fall. Previous awardees with late reports or outstanding balances are ineligible for funding.

The CDFI Fund’s Capacity Building Initiative, commonly referred to as the Technical Assistance (TA) component provides TA grants to CDFIs with the goal of building the capacity of the CDFI industry. Grants may be used for a wide range of purposes. For example, awardees can use TA funds to purchase equipment, materials, or supplies; for consulting or contracting services; to pay the salaries and benefits of certain personnel; and/or to train staff or board members. The CDFI Fund makes awards of up to $100,000 under the TA. component of the CDFI Program.

The Native American Initiatives Program targets CDFIs serving Native American communities and are designed to overcome identified barriers to financial services in Native Communities. These initiatives seek to increase the access to credit, capital and financial services in Native Communities through the creation and expansion of CDFIs primarily serving Native Communities.

Through the use of monetary awards and training opportunities, the CDFI Fund’s Native Initiatives program creates jobs, builds businesses, and fosters economic self-determination in Native Communities nationwide. The Native Initiatives program has:

- Awarded more than $120 million in financial and technical assistance to CDFIs

- Provided more than 1,600 hours of training to Native CDFIs through recent trainings

As part of the CDFI Program, the CDFI Fund also offers supplemental awards through the Healthy Food Financing Initiative. CDFIs that are selected to receive a Financial Assistance award may also receive a Healthy Food Financing Initiative award to expand their healthy food financing activities.

Download the Healthy Food Financing Initiative Fact Sheet (English / Español).

The Bank Enterprise Award (BEA) Program awards FDIC-insured depository institutions for increasing their investments and support of CDFIs and advancing their community development financing and service activities in the most economically distressed communities. Over the past three years, BEA Program awardees have increased:

- Their investments in certified CDFIs by $102.9 million;

- Their loans and investments in distressed communities by nearly $1.4 billion;

- The provision of financial services in distressed communities by $50.2 million

The Capital Magnet Fund offers competitively awarded grants to finance affordable housing solutions and community revitalization efforts that benefit low-income people and communities nationwide.

Through the Capital Magnet Fund, the CDFI Fund provides competitively awarded grants to CDFIs and qualified non-profit housing organizations. These awards can be used to finance affordable housing activities, as well as related economic development activities and community service facilities. Awardees are able to utilize funds to create financing tools such as loan loss reserves, revolving loan funds, risk-sharing loans, and loan guarantees.

Organizations that receive Capital Magnet Fund awards are required to produce housing and community development investments at least ten times the size of the award amount, generating a multiplier effect that means that more low-income people and low-income communities nationwide will have housing options within their financial reach.

To date, the Capital Magnet Fund has:

- Generated $20 of additional investment for every $1 of award funding.

- Created over 13,000 affordable homes, including more than 11,500 rental housing units and more than 1,500 homeowner-occupied units.

Through the CDFI Bond Guarantee Program, the Secretary of the Treasury makes debt available to CDFIs from the Federal Financing Bank. The loans provide long-term capital not previously available to CDFIs, and inject new and substantial investment into our nation’s most distressed communities. The CDFI Bond Guarantee Program has guaranteed nearly $1.7 billion in bonds to date.